Showing 1 - 10 of 12 posts found matching: taxes

Thursday 14 March 2024

The headline at Atlanta's Fox 5 was "Over 850 pounds of crystal meth found in Norcross storage unit." My first thought on reading the article was, "wow, that's a lot of drugs." My second thought was, "how do you dispose of that much meth?" The article didn't say, which if you ask me is a real indictment of the modern clickbait era of journalism.

Left to my own devices, I did what I usually do when I have a question: I googled it.†

That was a mistake.

I only write this so that when I am arrested and the DA introduces into evidence my Google search history and social media feeds full of helpful instructions about what I should do with my stash when the cops inevitably come kicking in my door, I can say that it was all because I read a poorly reported news story.

(To save you the same trouble, let me report that the answer appears to be "mix it with bleach." I'm guessing a lot of bleach. I have not yet worked up the courage to google how to dispose of that.)

† In addition to "how to dispose of crystal meth," these are some other actual Google searches I made in the last 2 weeks: "who likes licorice," "why am I paying 24% taxes," "life is not all sex and sun lamps," and "green lantern condoms." What can I say? I'm a curious guy.

Comments (0) | Leave a Comment | Tags: drugs internet news walter

Thursday 14 April 2016

Taxes are due tomorrow, which means that many, many Americans are knee-deep in financial stress and frustration. Somehow, Atlanta's NPR station, 90.1 WABE, has selected this week for its spring membership drive. I'd say that's some terrible timing, but I guess WABE needs to pay taxes, too.

Sorry, NPR. I'm down about $5,000 right now. Will you take a rain check? Because Uncle Sam sure won't.

Comments (1)

| Leave a Comment | Tags: rant taxes walterThursday 8 August 2013

The Washington Post, soon to be the property of Amazon.com founder Jeff Bezos (you'd think if anyone knew that no one reads newspapers anymore, it'd be Bezos), reports that people are more more inclined to buy lottery tickets at stores that have previously sold winning tickets.

Stop and think about that for a minute. The people who are willing to give someone their money in the hopes of collecting something for nothing think that they will have better odds playing at a place where someone else already won even though the concept is easily disproven by empirical data. Yeah, that sounds about right.

It seems that we should be able to exploit this information. American hate paying income taxes; recent polls indicate that at least half of all Americans think their taxes are too high. But lottery jackpots frequently approach $100 million, 10 times the lifetime earnings of the average American. Obviously, many of these same malcontents who have a problem paying the government have no problem throwing away their earnings on empty dreams. (The odds of winning a Mega Millions jackpot is about 1 in 175 million. Being struck by lighting is 1 in 500 thousand.)

Maybe the IRS, which is desperate to recover its good name (ha!) after treating Tea Partiers like Wesley Snipes for the past few years, should consider just telling the people that if they give the government some of their money, they might just get a multi-million dollar tax return next year. The winner will be so pleased to win, he probably won't even care that he'll have to pay half his winnings back to the government.

The best part of this plan is that once there is a winner, everyone else will willingly come back year after year to keep giving the IRS more and more of their money. You're welcome, IRS.

Comments (0) | Leave a Comment | Tags: lottery news taxes

Tuesday 14 August 2012

The IRS has apparently found a way to raise money without actually raising taxes. I don't know what the IRS calls this process, but the common term for it is extortion.

I just received in the mail a letter from the IRS dated August 13, 2012. The letter is essentially a bill for "unpaid taxes" in the amount of $19.28. I already wrote the IRS one check back in April, but it seems that wasn't enough. Somehow, the IRS suspects that I have money I haven't given them yet. I knew those traffic cameras were up to no good!

The letter doesn't say why I owe an additional $19.28, or how they came to the calculation that I owed an additional $19.28. It just says, "If you don't pay $19.28 by August 23, 2012, interest will increase and additional penalties may apply. If you don't pay your tax debt, we have the right to seize ('levy') your property." Why bother with the carrot when you already have a stick, huh, IRS?

And here's the point: I'm going to pay it. Sure, I could write the IRS and ask why they are hassling me for a sawbuck, but I'm not going to. That would take more time than it will take me to earn an additional $20 to pay this bill. Therein lies the genius of their plan.

If they sent this letter to the supposed half of the United States population that filed income tax returns in 2012, everyone would pay it just to not be bothered taking the time and effort to challenge it. The IRS would add a windfall of $3 billion to its coffers. While that may not be enough to pay for Obamacare or whittle down the U.S.'s bloated deficit, $3 billion will still buy the Pentagon at least a couple of hammers.

Comments (0) | Leave a Comment | Tags: politics taxes walter

Monday 2 May 2011

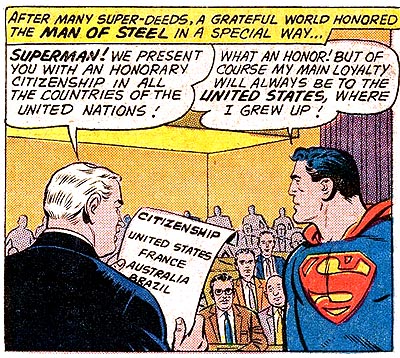

In one panel of one of the several stories in last week's anniversary edition of Action Comics #900 (!), Superman announced his plan to renounce his American citizenship in order to truly be a hero for the world. Superman spoketh, and thusly the internet exploded:

Google Images search result for "superman citizenship" on May 1, 2011.

In the story, Superman explains that his American citizenship has become a liability as it gives rogue nations an excuse to blame the citizens of America for Superman's actions against their tyranny. Superman expresses the belief that surrendering his U.S. citizenship will make his work to save us from ourselves easier. This was deemed newsworthy by many, many news organizations that you would really think had better things to do.

A case could perhaps be made against publisher DC Comics' agenda for Superman's citizenship status -- the controversy has already resulted in reports of media-frenzied sales increases, and rumor has it that this story written by David Goyer is laying groundwork not for future comic book stories, but the planned Man of Steel movie written by David Goyer -- but most people seemed to focus their ire at Superman himself. The argument mainly boiled down to "you're either with us or you're against us." There might be some truth to that, but if I have to pick a side, I pick Superman's.

Personally, I don't see how surrendering his American citizenship is supposed to aid Superman against Iran or Libya or whatever other country hates the United States this afternoon. It's a pretty good chance that they are going to hate Superman whether or not he says he stands for the American Way, because those countries also hate truth and justice.

Even if Superman is being naive, I don't think that makes him the bad guy here. For one thing, what difference does it make if Superman even has American citizenship? What right do we Americans have to be jealous girlfriends and scream, "keep your hands off off our man, you bitch," to the rest of the world?

Superman was born on a distant planet and is the definition of "illegal alien." He has no income and pays no taxes. Superman doesn't vote or sit for jury duty. Are we planning on telling Superman that he's not allowed to enter our borders to help us against tornadoes, forest fires, or super-villains because he's not a U.S. citizen? Wouldn't that make us the same as the tyrants that Superman is trying to fight?

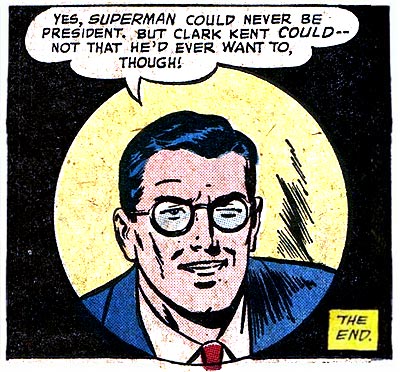

Besides, while Superman is publicly expatriating, Clark Kent is not. Some will call that hypocritical, but remember that Superman isn't surrendering citizenship because he has a problem with America. This is a political, public relations ploy by a non-existent alter-ego, not a comment on American politics (which Superman is above, figuratively and literally). Mild-mannered Clark Kent will remain as American as apple pie. That's good enough for me.

Comments (0) | Leave a Comment | Tags: comic books laws news politics rant superman

Sunday 21 February 2010

I've had a few people tell me in recent weeks that they read my blog, but they don't care for the comic book parts. That made me curious: what do you guys prefer to read about? Let me know by using the simple poll below. (I'll let you kno what the results were at the beginning of March.)

Disclaimer: I'm asking for what you like here at wriphe.com/blog, nothing else, so don't get too cute. This poll does not constitute a promise to cater to your whims. In fact, if anything, I'll try harder to keep what you like from you. But if you've been coming here long enough to have an opinion about what you like, you probably already knew that.

Comments (4)

| Leave a Comment | Tags: blog wriphe.comTuesday 9 February 2010

An update to some previous blog entries:

First things first. On my last post, I covered the Scripps Howard celebrity Super Bowl poll. And now that the game is over (damn you, Saints!), it should be pointed out that the celeb who picked closest was Joe Mantegna, who predicted Saints, 28-17. Outperforming a majority of the celebs were video game simulations run by newfangled Madden 10 and classic Tecmo Super Bowl, both of which had forecast a Saints win. So keep in mind that the next time you need to turn to someone to advice, you'd be better off talking to a computer screen than your average celebrity.

On December 17, 2008, I mentioned that New York was planning to tax soda consumption. It failed to pass. According to the Houston Chronicle, a similar fate has just quietly befallen a federal measure with the same intent. Sure, raising taxes on an item to increase revenue and decrease health risks sounds good, but who really wants to pay an extra 15 cents per can of soda when they could instead pay higher income taxes? No one I know, that's for sure.

And speaking of predictions, last week I noted two separate incidents of single-vehicle accidents on the same stretch of road. Now another mysterious accident claimed the life of a third person, who was found mauled in the middle of that road. Police have no clues about the third death in three weeks on Newnan Crossing Bypass, but are guessing hit-and-run at 4AM in the morning. You heard it here first, people. Grab your .30-30s, the Great Deer Uprising of 2010 continues.

Comments (0) | Leave a Comment | Tags: coke football great deer uprising of 2010 newnan news politics scripps super bowl video games

Sunday 5 July 2009

Signs that you're getting old: you don't recognize the coins in your pocket. Arriving home from the grocery store, I reached into my pocket and withdrew 32¢: one quarter, one nickel, and two pennies. And I'd never seen any of them before.

I know that they're making quarters for every state in the union, but this one was quite unexpected: it's Puerto Rico. The Commonwealth of Puerto Rico is a self-governing US territory. Puerto Rican citizens have dual US/Puerto Rican citizenship, but are not subject to US income taxes. Though its citizens are allowed to vote in US elections, they have no direct voice in the US congress. So why exactly are they on my money? While I think it's cute that Puerto Ricans have finally taken their place beside the Indians Native Americans as currency mascots of protestant Manifest Destiny, I'd personally much rather see a powerful bison or majestic eagle on my coins than an advertisement for a tropical tourist trap that I'm paying to help support.

Speaking of buffaloes, the nickel in my pocket was the most familiar coin. On one side was Thomas Jefferson and on the other was Monticello. That's what was on nickels when I was a kid. Heck, it's what was on nickels when my grandfather was a kid! Only now Mad Tom sits off to the left of the coin, smirking at me. I'm sure he didn't pull that sort of sass with my grandfather, or his generation never would have given up their buffalo nickels. A quick search through the spare change cup on my desk uncovers not one or two but five (!) different nickel designs, none dated prior to 1996. That's 6 different coins in just over a decade! If they weren't all exactly the same size, I know I'd be in trouble at motel vending machines.

The two 2009-minted cents I received showcase Abe Lincoln on both sides, presumably because you can never, ever get enough Lincoln. "Heads" is the Lincoln portrait that's been tarnishing on pennies for a century, and "tails" is what will no doubt become known as the "lazy Lincoln" portrait of young Lincoln shunning his wood-chopping duties to read what I'm sure was the 19th-century equivalent of Us Weekly Magazine. An internet search reveals that there are 4 different cent designs released this year in a tribute to Lincoln's 200th birthday, with more due next year.

Why so many all-new, all-different coins? Both pennies and nickels have in recent years cost more than their face value to make, so why are we making so damned many? Is the US Treasury desperately hoping that people will take these coins out of circulation as "collectibles" so that the world won't ever catch on to just how many they're minting? (Hello? Inflation?) If so, they should go ahead and start making Obama coins. I'm sure that there are still quite a few people out there who would each save a few hundred Obama 3¢ pieces figuring to use them to put their kids through college once they've

Meanwhile, if you're forced to stand behind me at Target, I apologize in advance for the wait. It's probably probably because I'm trying to figure out what combination of round collectible discs will add up to the 69¢ I need to buy penny candy. Now I know why all old people need glasses.

Comments (0) | Leave a Comment | Tags: coins history

Wednesday 15 April 2009

Like most people not expecting a tax refund, I just finished my income tax filing. This year I had to pay taxes. Not because I made a lot of money, mind you. My gross income was well below the national poverty line. Granted, "poverty" in the United States is a pretty relative term when compared to incomes around the world. So while I may not be "poor" in the Slumdog Millionaire sense of the word, I'm not going to be helping the U.S. out of a recession any time in the near future, either.

The national poverty line of the United States is defined as the annual income required for the average American to sustain his own basic needs. In 2008, this has been estimated at about $11,200. (Yet more proof that I am not average.) Comparing this number to the median income of American citizens, about $27,000 according to the World Salaries Group, you can see where I fit in. My income is closer to that of the average citizen of Russia. (Who won the Cold War? Not me.)

Our friendly U.S. Government graciously allows a single citizen who earns a "gross income" of less than $8,950 to bypass filing taxes. (Presumably, this is the threshold where the income tax rate overcomes government subsidy. You can't get blood -- or taxes -- from a stone.) Sadly, I qualify.

"Not so fast," cries my Uncle Sam. Because in 2008 I tried to earn income as a self-employed graphic/website designer, I am required to file taxes so that I can pay the government the "self-employment" tax used to sustain my Social Security and Medicaid benefits. Nuts!

If in 2008 I had worked exclusively for an employer other than myself earning the same amount, my meager income would have been taxed nothing (thanks to the Standard Deduction). The IRS would have refunded whatever my employer had withheld on my behalf, and thanks to the Earned Income Credit established in the 1975 (the year of my birth -- someone must have known I was coming!), the government would have paid me money to help offset my relative poverty. But alas, that is an alternative history. Instead, I made more than $400 for myself on my own terms, and now I'm paying for it. Literally.

Well, I've learned my lesson. Working for myself has cost me money. From now on, I'll only do toadie work for someone else or do no work at all. So employers, if you're interested in hiring a talented fool who will work for peanuts -- and I mean actual peanuts: I'm hungry, and I just gave my last dollars to the government -- I'm your lackey.

Comments (0) | Leave a Comment | Tags: laws taxes work

Wednesday 17 December 2008

New York Governor David Paterson has proposed an 18% "obesity tax" on soft drink sales in New York state. The American Beverage Association objects ('natch), claiming that this tax will put the squeeze on the middle class. ("In an economy like this, the last thing we should do is raise taxes on hardworking families." -ameribev.org )

Let's say I consume a single 2-liter Coca-Cola every 2 days. That's 180 2-liters per year. (Don't judge me.) At $1.50 per 2-liter, that's $270 I spend on Coke per year. I already pay 7% sales tax for Coke, meaning that $270 of Coke costs me $288.90. If I were forced to pay an additional 18% tax on top of that, those 180 Cokes cost $337.50, a nearly $50 increase over the course of a year. (That's a lot more than I spend on comic books these days.)

Even in these hardscrabble times, that's not really a lot of money. And I drink a LOT of Coke. (Don't judge me.) How many families in New York consume as much soft drink per person as I do? Turns out that according to the National Soft Drink Association, the national average is somewhere near 105 2-liters per American per year. For the average New Yorker (at, say 1700 Broadway in Manhattan, the home of DC Comics) paying a sales tax of 8.375% on that same $1.50 Coke, they'll be paying $199.04 instead of $170.69, an annual difference of about $30.

Needless to say, ABA, I don't think this will break the back of New Yorkers. And the number is so low, that it is unlikely to really discourage that many obese middle class buyers. (Though I do think of my dad, who won't buy any 2-liter soft drink at a cost greater than $1.00, because "the price was never that high when I was a kid!")

But don't take this article as me supporting the government involving itself in my buying habits on the grounds that it knows better than I do what's good for me. I'm the guy that opposes seat belt laws, remember? If I want to get too fat from sipping sugary beverages to be thrown to my death from my car in an accident, I think that's my right!. And I'll let the ABA use that argument if they think it will help them.

Now if you'll excuse me, I think I'll go to work saving my life by pouring another Coke.

Comments (0) | Leave a Comment | Tags: coke economy laws taxes